During Stampix’s recent webinar on Loyalty for FMCG, we had the pleasure of exchanging thoughts with Rich Long, Senior Manager Next Gen DTC – Global Loyalty at PepsiCo. Rich provided an inside look into PepsiCo’s current and future loyalty strategies. His insights shed light on how a global giant like PepsiCo approaches loyalty and adapts to the changing market landscape. Through participation in the Certified Loyalty Marketing Professional (CLMP) training, PepsiCo provides its executives with foundational knowledge about loyalty marketing. Rich explained that this is essential for effectively implementing and managing loyalty programs across various markets, and understanding loyalty dynamics to enhance consumer engagement and drive business growth.

Connecting the dots between portfolio brands

PepsiCo already operates several successful loyalty programs, such as the Joy program in Mexico and KazandiRio in Turkey. Through their application “PepsiCo KazandiRio!”, consumers can scan unique promotional codes on their favourite PepsiCo snacks and instantly access redeemable rewards. According to adesso, PepsiCo’s KazandiRio app has exceeded 10 million downloads and has 3 million monthly active users.

These programs are currently being reimagined and along with exploring new direct-to-consumer (DTC) opportunities, as part of PepsiCo’s efforts to get more closely connected with its consumers.

Talking about connection, one of the challenges for PepsiCo is ensuring that consumers recognize the breadth of its brand portfolio. Many consumers may not realise that popular brands like Pepsi, Lay’s, Gatorade, Quaker, Starry, Aquafina, Doritos, Cheetos and Ruffles, along with many other regional and local brands, are all part of the same company. By increasing awareness and creating a more integrated brand experience, PepsiCo aims to enhance loyalty and provide more rewarding experiences for its consumers.

The Role of FMCG Loyalty Programs

A common question is whether loyalty programs will merely retarget existing buyers who already have a high brand awareness (and loyalty). While PepsiCo brands typically enjoy high awareness, loyalty programs can still play a crucial role in maintaining consumer engagement. Effective loyalty programs are designed thoughtfully to create a seamless onboarding and engagement experience, which helps reinforce loyalty even among well-known brands. Additionally, loyalty programs can introduce consumers to other less familiar brands within the PepsiCo portfolio, thereby increasing their mental availability.

The role of loyalty programs in this category should not be purely transactional. Instead, they should focus on continuous engagement and building brand affinity & equity, regardless of the purchase cycle. This approach helps maintain a constant connection with consumers and drives long-term loyalty.

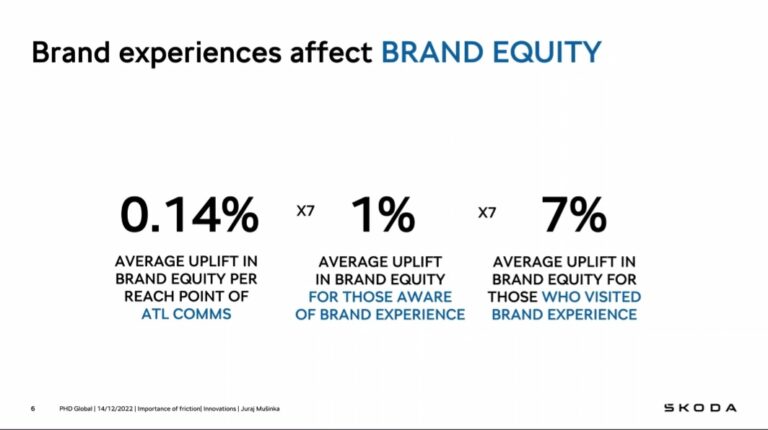

Research from PHD Global shows that consumers (and especially Gen Z) are seeking brand experiences that enrich their lives. What’s in it for the brand? It turns out that taking part in such a brand experience can produce a lift in brand equity from 0.14% to 7%.

Or to use Byron Sharp’s words: the return comes from an increase in mental availability for the brand.

Balancing Reach and Loyalty

In his book ‘How brands grow’, Byron Sharp makes the case for brand growth by reaching all category buyers, and acquiring light buyers in the category. But to reach millions of light buyers, brands need deep pockets – especially with the ever rising cost of online advertising.

On top of that, there is the problem of ad fraud as pointed out by several people in the audience. Bob Hoffman, author of “BadMen,” and a critical voice in the digital advertising industry points out that a whopping 52% of all web traffic is non-human (bots). According to some sources, 60% of the amount invested in programmatic advertising remains stuck in the hands of intermediaries. Bob Hoffman takes it a step further: by taking into account viewability and ad fraud, he arrives at a meagre 3% of budget that ultimately achieves its goal. For a deep-dive on this topic, we suggest in this podcast by Uncensored CMO.

So while reach and loyalty are not mutually exclusive, they need to be balanced. For PepsiCo brands, which do not own their distribution channels, third-party platforms may be necessary to extend reach and acquire new customers. Optimising these channels and integrating them with a proprietary loyalty program can enhance both reach and loyalty.

When it comes to measuring the loyalty program’s effectiveness, the key performance indicators (KPIs) should be tailored to the specific goals of the loyalty program. Regularly monitoring these metrics helps brands understand the health and performance of the programs and identify areas for improvement. First-party data provides deep insights into customer behaviour, preferences, and needs, enabling brands to personalise their offerings and increase program relevancy.

Learning from Other Brands

During the webinar, panellists raised examples like Starbucks, Nike, and McDonald’s as successful loyalty strategies. McDonald’s, in particular, has made significant strides with its MyMcDonald’s Rewards program, which launched in the summer of 2021. In his blogpost, Vikram Chawla explains that by Q1 2024, the program contributed an impressive $6 billion to McDonald’s sales. The rapid expansion into new markets and surge in active members—from 50 million to 150 million by the end of 2023—demonstrate its success. The program’s enhanced engagement and personalised experiences have increased contributions from loyalty members to total sales, rising from 15.5% in 2023 to 20% by Q1 2024. As a result, McDonald’s plans to double down on loyalty, investing hundreds of millions into digital innovation and marketing to further personalise customer experiences and drive growth. (Source: Restaurant Business)

On the contrary, Coca-Cola’s My Coke Rewards was discontinued due to its transactional focus and operational flaws. This example highlights the importance of aligning loyalty programs with brand values and ensuring they offer more than just rewards for transactions. Effective loyalty programs for FMCG should foster deeper engagement and build brand equity. (Source: the wise marketer)

Conclusion: A Strategic Approach to Loyalty

PepsiCo’s approach to loyalty is multi-faceted, focusing on building foundational knowledge, creating integrated brand experiences, leveraging first-party data, and balancing reach with loyalty. By reimagining existing programs and continuously improving their strategies, PepsiCo aims to enhance consumer engagement and drive sustainable growth.

Successful FMCG programs do more than just reward purchases. Instead they magnify the brand’s core messages and values, simplify the customer experience, and align seamlessly with the brand’s overall marketing strategy.

“I think too many brands out there focus on developing a program with solid mechanics, and forget about connecting with their customers in a meaningful and relevant way. If a brand does it well, that existing customer loyalty can be reinforced or even created.” – Rich Long

Lastly, loyalty programs enable direct dialogue with verified customers, should be a 2-way street, for the brand to recognize, appreciate and reward its members and also enable a member to express their loyalty back in various forms.

SIGN UP FOR THE WHITE PAPER

We didn't have time to answer all questions from the audience during the webinar. Subscribe to our Newsletter to receive an exclusive White Paper with the key insights and answers from the panelists.